[Download Now] The 13-Week Cash Flow Model

$100.00$399.00 (-75%)

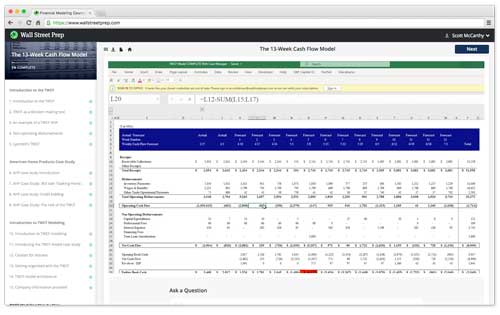

Complete 13-Week Cash Flow (TWCF) Training: This course is a step-by-step buildup of a fully integrated 13-week cash flow model in the context of a turnaround and financial restructuring.

Matan Feldman – The 13-Week Cash Flow Model

Check it out: Matan Feldman – The 13-Week Cash Flow Model

64 Lessons

5h 10m

28,177 Students

Learn how to build an Integrated 13-week cash flow model step-by-step.

Why you should take this cash flow modeling course

What You’ll Learn

Integrated 13-Week Cash Flow Modeling

Working Capital & Other Rollforwards

Borrowing Base & Revolver/DIP Modeling

Reconciling EBITDA to the 13-Week Cash Flow

Case Manager and Multiple Scenarios

Converting Monthly to Weekly Forecasts

General Ledger Accounting Mapping Best Practices

- Complete 13-Week Cash Flow (TWCF) Training: This course is a step-by-step buildup of a fully integrated 13-week cash flow model in the context of a turnaround and financial restructuring.

- Not Just Concepts – Real World Modeling: Using a case study, you will build a fully-integrated model as you would on the job. This is the only course available that teaches complex model mechanics for a 13-week cash flow model while weaving the motivations of the various stakeholders during both in court or out of court turnarounds.

- Excel Model Templates Included: Complete 13-Week Cash Flow Model template included with this course

Who is this program for?

- Turnaround Consultants & Advisors

- Restructuring Investment Banking Professionals

- Distressed Debt Investors

- FP&A and Corporate Finance

- Private Equity Professionals

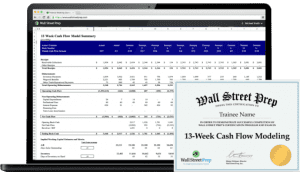

Wall Street Prep delivers restructuring training to some of the world’s leading turnaround consulting & advisory firms, investment banks and distressed debt funds

Course Samples

Getting organized with the TWCF

Modeling 30000 foot view

Building a case manager into a TWCF

Course Highlights

Taught by experienced professionals

Our instructors are former finance professionals and consultants who know what it takes to build great looking decks during deals and client engagements.

The same employee training used at top firms

This is the same course our corporate clients use to teach their finance professionals and consultants how to build better pitchbooks and client decks.

Breeze though lesson videos at 1.5x & 2x speed

Save loads of time by bumping up playback speed to breeze through lessons at your own pace.

Get instructor support throughout the course

Have a question on course content? Communicate directly with instructors by asking questions throughout the course.

Course TOC

Introduction to the TWCF

1 TWCF Course Welcome 5:56

2 Introduction to the TWCF 5:56

3 TWCF as a decision making tool 4:40

4 An example of a TWCF AHP 4:58

5 Non-operating disbursements 2:03

6 Lyondell’s TWCF 6:22

American Home Products Case Study

7 AHP case study introduction 6:08

8 AHP Case Study: 363 sale “Stalking Horse Bidder” 3:09

9 AHP case study: Credit bidding 3:53

10 AHP Case Study: The role of the TWCF 4:42

Introduction to TWCF Modeling

11 Introduction to TWCF modeling 3:50

12 Introducing the TWCF model case study 4:25

13 Catalyst for distress 2:29

14 Getting organized with the TWCF 4:23

15 TWCF model architecture 2:41

16 Company information provided 3:52

TWCF Modeling Step-by-Step

17 Modeling 30000 foot view 3:20

18 AR rollforward 15:56

19 Modeling disbursements 6:19

20 AR rollforward complete 5:02

21 Non-receivables receipts 6:09

22 Forecasting empoyee wages 2:55

23 Payroll Excel solution 2:02

24 Wages payable rollforward 1 2:34

25 Wages payable rollforward 2 2:43

26 Inventory rollforward intro 4:11

27 DOH and inventory turnover 3:18

28 Interpreting inventory KPIs 1:09

29 Building the inventory rollforward 10:27

30 Accounts payable rollforward intro 1:14

31 DPO calculation and KPI discussion 2:27

32 Building the AP rollforward 3:01

33 Forecasting inventory disbursements 3:22

34 Rent utilities other disbursements 1:26

35 Modeling other disbursements 2:59

36 Modeling non-operating disbursements 3:40

37 Capital expenditures 1:12

38 Professional fees 1 2:13

39 Professional fees 2 0:54

40 Interest payable and debt rollforwards 5:04

41 Completing the pre-revolver TWCF 6:21

Borrowing Base and Revolver

42 Borrowing base modeling 8:32

43 Borrowing base solutions 4:10

44 Revolver mechanics 4:59

45 Modeling the revolver 12:23

46 Modeling revolver interest 6:56

47 Avoiding a circularity 2:49

EBITDA Reconciliation

48 EBITDA reconciliation 5:01

49 Modeling EBITDA to cash flows 1 4:55

50 Modeling EBITDA to cash flows 2 3:42

Case Manager and Sensitivity

51 Building a case manager into a TWCF 8:15

52 Integrating cases into the TWCF 9:38

53 Sensitizing individual drivers 3:17

Adding Model Complexity

54 Most common TWCF complexities 0:55

55 Working with messy data 2:34

56 Commingled line items 2:43

57 Forecasting a Messy Monthly IS 1 5:42

58 Forecasting a Messy Monthly IS 2 5:54

59 Forecasting a Messy Monthly IS 3 2:00

60 Converting Monthly Data to Weekly 1 13:14

61 Converting Monthly Data to Weekly 2 13:29

62 Remodeling: Updating TWCF for new weeks 9:14

Account Mapping Using SUMIFS

63 Account mapping 3:39

64 Using UNIQUE to map accounts 5:37