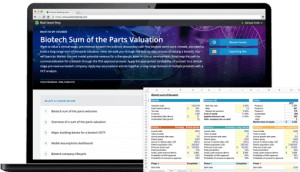

[Download Now] Biotech Sum of the Parts Valuation

$50.00$199.00 (-75%)

Want to value a clinical-stage, pre-revenue biotech? An ordinary discounted cash flow analysis won’t cut it. Instead, you need to build a long-range sum-of-the-parts valuation.

Biotech Sum of the Parts Valuation

Check it out: Biotech Sum of the Parts Valuation

Biotech Sum of the Parts Valuation

Ideal for investment banking private equity and VC professionals focusing on the biotechnology industry, you will learn how to build a biotech-sum-of-the-parts valuation the way it’s done on the job.

Real World “On the Job” Biotech SOTP Valuation

- Want to value a clinical-stage, pre-revenue biotech? An ordinary discounted cash flow analysis won’t cut it. Instead, you need to build a long-range sum-of-the-parts valuation.

- This 60-minute video short course + model template bridges the gap between academics and the real world and equips trainees with the practical modeling skill set needed to build a biotech SOTP Valuation.

- This course assumes no prior knowledge in biotech company valuation.

- Excel Model Template Included: A biotech sum-of-the-parts (SOTP) model template is included with this course

Who is this program for?

This biotech sum-of-the-parts valuation course is designed for professionals and those pursing a career in the following finance careers:

- Investment Banking

- Venture Capital

- Private Equity

- + Anyone who wants to learn how professionals build a biotech-sum-of-the-parts valuation

Wall Street Prep’s Biotech Sum of the Parts Valuation is used at top financial institutions and business schools.

Course Samples

Prerequisites

This course does not assume a prior background in Biotech or Healthcare. However, those who enroll should have an introductory knowledge of accounting (e.g. interaction of balance sheet, cash flow, and income statement) and proficiency in Excel. Students with no prior background in Accounting should enroll in the Accounting Crash Course. Students with limited experience using Excel should enroll in the Excel Crash Course.

Course Extras

Taught by bankers

Our instructors are former investment bankers who give lessons real-world context by connecting it to their experience on the desk.

Used on the Street

This is the same comprehensive course our corporate clients use to prepare their analysts and associates.

Free Unlimited Access to the WSP Support Center

Receive answers to questions, free downloads, and more from our staff of experienced investment bankers

Course TOC

19 Example: Blueprint Medicines Corp 4:41